“Value is created by the compression of time.”

The quote above comes from Peter Drucker, an acclaimed management consultant who wrote nearly 40 books during his career and who is widely recognized as a sort of “Einstein” of American management theory. In the context of energy efficiency, this quote means that if you know that there is something valuable that you should be doing to enhance energy efficiency, the faster you do it, the more value you will create for your shareholders or other stakeholders.

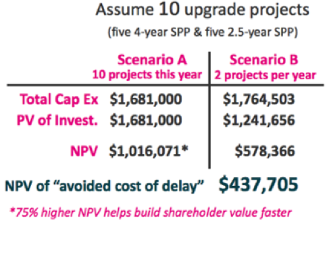

Conveying the cost of delay with calculations using hypothetical scenarios can be very effective in motivating your prospect to take action immediately. Below, you’ll find a pair of scenarios that uses five four-year simple payback period projects and five two-and-a-half-year simple payback period projects (not that I embrace simple payback period as a metric… this just gives you some layman’s terms that allow you to get your arms around how quickly these projects provide financial returns).

In Scenario A, you do all ten projects this year. In Scenario B, you do two projects per year over the course of five consecutive years.

If you do Scenario A, you will invest approximately $1.7 million, and over a five-year investment horizon, you'll wind up with a net present value of $1,016,071.

If you do Scenario B, it will cost you slightly more to fund the projects (because inflation raises the price of labor and materials over the course of five years), and when you add up the savings that you are getting from all of these projects, your decision to phase in the projects costs you over $400,000 in net present value.

So why is there such a big difference in net present value? If you only do two projects in Year 1, you have eight other projects that have not yet begun producing savings. In the second year, you have two more projects feathered in; however, you still have six projects that have not yet started their savings streams. Ultimately, you have this delta of missing savings, and that is what constitutes the $437,000 in lower net present value.

Keep in mind what this means. You can get a 75% higher net present value if you did all 10 projects this year as opposed to phasing them in over a five-year period.

Now, your prospect may see this information and express concern about having the manpower to do all 10 projects in one year. When this kind of objection comes up, I would say something like, “Well, $437,000 of additional net present value buys a heck of a lot of performance bonuses, not to mention Chinese food and pizza in late night conference settings to make sure these projects are done.”

Then they may say, “Well, I don’t have the money.” How do you respond to this? Ask them a question like, “If I offered to give you a 25% discount on any of the projects that you do manage to get done this year, how many of these 10 projects would you get done?” Most people say, “Wow, 25% off?! For a discount like that, I would probably do all of them.” Then you respond, “Okay, well let’s take a closer look at the numbers. The $437,000 of net present value is very close to 25% of the $1.681 million of first cost. So, if you’re telling me that you would jump through hoops to find the money, find the staff, and find the resources, even if you had to outsource and borrow some money to get these projects done at a 25% discount, essentially that is what you would be getting without an additional discount – assuming you do all ten projects this year.”

Finally, they may express concerns about the debt service, assuming they need to borrow money to do all the projects in one year. You can simply emphasize the fact that $437,000 pays for a lot of debt service, especially at the low interest rates that are now available for energy efficiency projects.

So what’s the moral of the story? Replace myth with math and motivation. Reframe the situation so that there is a compelling reason to move forward immediately.

If you were confused by any of the calculations used in this example, check out my three-part Financial Analysis of Efficiency Projects online training series. If you really understand how the math works, you’ll be better positioned to use it as a motivator in your next meeting.